Your Fixed or floating home loan which one images are available. Fixed or floating home loan which one are a topic that is being searched for and liked by netizens today. You can Get the Fixed or floating home loan which one files here. Get all royalty-free images.

If you’re looking for fixed or floating home loan which one images information linked to the fixed or floating home loan which one interest, you have come to the ideal blog. Our site always gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

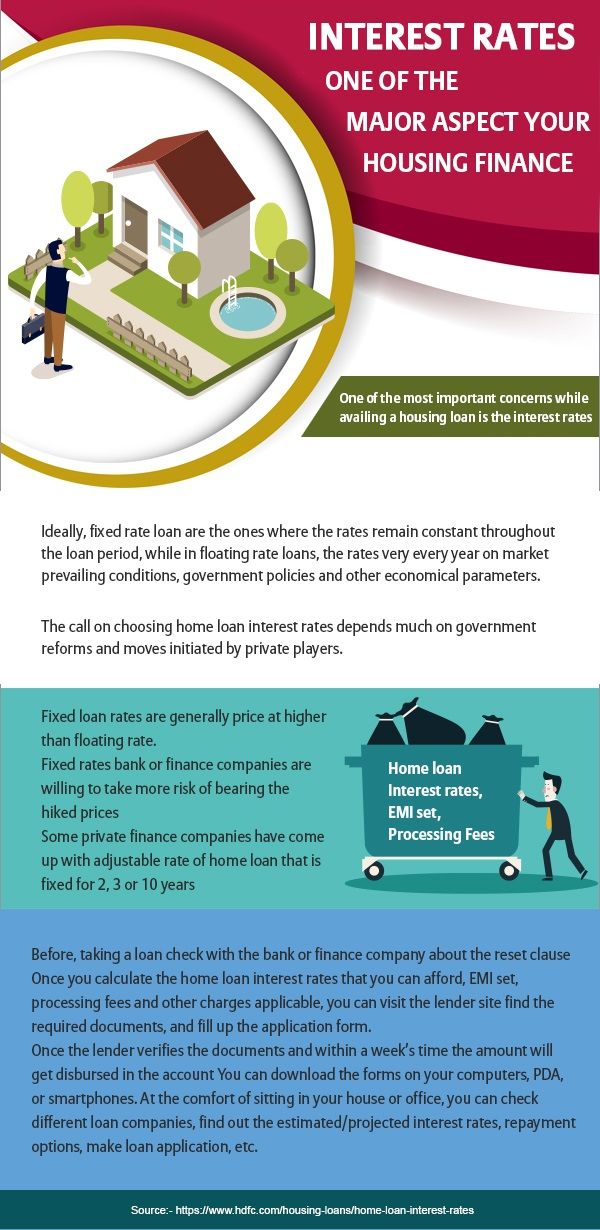

Fixed Or Floating Home Loan Which One. A mix of fixed and floating You can split a loan between fixed and floating rates. Meanwhile if you had a floating rate and the Reserve Bank reduced the cash rate again the bank may pass on that reduction in interest rates to your loan. Fixed interest rate home loans are rather self-explanatory because well the annual. Advantages of Floating Interest Rate Loan.

Pin By Ifl Housing Finance On Home Loan Best Home Loans Home Loans Finance From in.pinterest.com

Pin By Ifl Housing Finance On Home Loan Best Home Loans Home Loans Finance From in.pinterest.com

Floating rates are slightly lower than fixed rates. The interest rates on such loans remain unchanged for a specified period of time after which the. The loan option does not allow borrowers to benefit from decreasing interest rates. Determining which home loan is best fixed or floating depends entirely on your financial situation and outlook but bear in mind that most home loan providers have a combination of the two. In case of floating rate interest loans you have to keep an eye on the interest rate you are paying and whether it is adjusted to the change in the BPLR. A mix of fixed and floating You can split a loan between fixed and floating rates.

Pritish should be aware of this when opting for the loan.

The loan option does not allow borrowers to benefit from decreasing interest rates. The most noticeable difference between fixed and floating interest rates for home loan is that fixed interest rates are higher than floating interest rates. Floating interest rate packages. If your primary concern is certainty and security then go for a fixed rate. Floating Rate Home Loan is availed at lower interest rate than Fixed Rate Home Loan. The difference can be anywhere between 1 and 25.

Source: in.pinterest.com

Source: in.pinterest.com

Fixed vs floating interest rate packages which ones for you. Cons Of Floating Home Loans. If you fix your home loan now your rate will stay at the same fixed rate for the fixed rate period regardless of whether rates do go down further or not so you may end up paying more interest than you need to. Pritish should be aware of this when opting for the loan. Fixed or Floating interest rate home loan which one is better.

Source: pinterest.com

Source: pinterest.com

Determining which home loan is best fixed or floating depends entirely on your financial situation and outlook but bear in mind that most home loan providers have a combination of the two. Before arriving at any decision you should compare home loans of various lenders. What is a SIBOR home loan. So if you are getting a floating interest rate of 115 per cent while the fixed loan is being. If interest rate rises the borrower has two options.

Source: in.pinterest.com

Source: in.pinterest.com

When it comes to choosing the type of interest rate a majority of home loan buyers go for floating rates. The difference can be anywhere between 1 and 25. If you fix your home loan now your rate will stay at the same fixed rate for the fixed rate period regardless of whether rates do go down further or not so you may end up paying more interest than you need to. Cons Of Floating Home Loans. But some borrowers might not mind paying a premium for the sense of certainty that loans with a fixed interest rate allow.

Source: in.pinterest.com

Source: in.pinterest.com

If the borrower wishes to avail the benefit of falling rates the loan should be refinanced. The lock-in period for floating rate loans are typically two years. But some borrowers might not mind paying a premium for the sense of certainty that loans with a fixed interest rate allow. What is a SIBOR home loan. Pritish should be aware of this when opting for the loan.

Source: pinterest.com

Source: pinterest.com

If the borrower wishes to avail the benefit of falling rates the loan should be refinanced. Floating interest rates are relatively lower than fixed rates of interest. If your primary concern is certainty and security then go for a fixed rate. Fixed or Floating interest rate home loan which one is better. This lets you make extra repayments without charge on the floating rate portion.

In case of floating rate interest loans you have to keep an eye on the interest rate you are paying and whether it is adjusted to the change in the BPLR. If interest rate rises the borrower has two options. But some borrowers might not mind paying a premium for the sense of certainty that loans with a fixed interest rate allow. In Singapore a Floating Rate home loan can be either a Singapore Interbank Offered Rate SIBOR-based loan or a Fixed Deposit Based Rate FDR loan. The biggest benefit with floating rate home loans is that they are cheaper than fixed interest rates.

Source: pinterest.com

Source: pinterest.com

Compare Floating and Fixed Interest Rates for home loan. Meanwhile if you had a floating rate and the Reserve Bank reduced the cash rate again the bank may pass on that reduction in interest rates to your loan. The first one is to increase the EMI keeping the tenure constant or to keep the EMI constant. This lets you make extra repayments without charge on the floating rate portion. If interest rate rises the borrower has two options.

Source: za.pinterest.com

Source: za.pinterest.com

Thereafter it turns into a floating interest rate home loan. But some borrowers might not mind paying a premium for the sense of certainty that loans with a fixed interest rate allow. This is known as time-bound fixed interest rate. Under floating home loan rates an individual is required to pay the monthly installments. If your primary concern is certainty and security then go for a fixed rate.

Source: in.pinterest.com

Source: in.pinterest.com

Floating interest rate packages. If you fix your home loan now your rate will stay at the same fixed rate for the fixed rate period regardless of whether rates do go down further or not so you may end up paying more interest than you need to. The interest rates on such loans remain unchanged for a specified period of time after which the. The lock-in period for floating rate loans are typically two years. The most noticeable difference between fixed and floating interest rates for home loan is that fixed interest rates are higher than floating interest rates.

Source: in.pinterest.com

Source: in.pinterest.com

Floating rate home loans may have more relaxed rules on partial repayment during the lock-in period. Floating interest rate packages. Fixed or Floating interest rate home loan which one is better. Meanwhile if you had a floating rate and the Reserve Bank reduced the cash rate again the bank may pass on that reduction in interest rates to your loan. Advantages of Floating Interest Rate Loan.

Source: in.pinterest.com

Source: in.pinterest.com

If you feel that the option you chose earlier is leading to more interest payment you can convert your loan from a fixed rate to a floating one and vice versa by paying a conversion fee. Fixed or Floating interest rate home loan which one is better. Fixed rates are slightly higher than floating rates. Under floating home loan rates an individual is required to pay the monthly installments. Under fixed rates an individual is required to repay the principal loan amount and interest in.

Source: pinterest.com

Source: pinterest.com

The biggest benefit with floating rate home loans is that they are cheaper than fixed interest rates. Floating rate home loans may have more relaxed rules on partial repayment during the lock-in period. Fixed vs floating interest rate packages which ones for you. The difference can be anywhere between 1 and 25. Fixed interest rate home loans are rather self-explanatory because well the annual.

Source: pinterest.com

Source: pinterest.com

If the borrower wishes to avail the benefit of falling rates the loan should be refinanced. Before arriving at any decision you should compare home loans of various lenders. Floating rate home loans may have more relaxed rules on partial repayment during the lock-in period. Differences between Fixed and Floating Interest rate loans The biggest difference is that the interest on a fixed rate loan is higher than a floating rate loan. Floating Rate Home Loan is availed at lower interest rate than Fixed Rate Home Loan.

What is a SIBOR home loan. Floating interest rates are relatively lower than fixed rates of interest. The difference can be anywhere between 1 and 25. Cons Of Floating Home Loans. What is a SIBOR home loan.

Source: in.pinterest.com

Source: in.pinterest.com

However it wont come without the premium on interest rates. Fixed vs floating interest rate packages which ones for you. A mix of fixed and floating You can split a loan between fixed and floating rates. The difference can be anywhere between 1 and 25. Splitting a loan can give you a balance between the certainty of a fixed rate and the flexibility of a floating rate.

Source: pinterest.com

Source: pinterest.com

If interest rate rises the borrower has two options. A mix of fixed and floating You can split a loan between fixed and floating rates. Differences between Fixed and Floating Interest rate loans The biggest difference is that the interest on a fixed rate loan is higher than a floating rate loan. Fixed or Floating interest rate home loan which one is better. Floating interest rates are relatively lower than fixed rates of interest.

Source: pinterest.com

Source: pinterest.com

This lets you make extra repayments without charge on the floating rate portion. Fixed or Floating interest rate home loan which one is better. This lets you make extra repayments without charge on the floating rate portion. Fixed rates are slightly higher than floating rates. The interest rates on such loans remain unchanged for a specified period of time after which the.

Source: in.pinterest.com

Source: in.pinterest.com

However it wont come without the premium on interest rates. Under floating home loan rates an individual is required to pay the monthly installments. Floating rate home loans may have more relaxed rules on partial repayment during the lock-in period. The biggest benefit with floating rate home loans is that they are cheaper than fixed interest rates. However it wont come without the premium on interest rates.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fixed or floating home loan which one by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.